Refer to the Form BE Guidebook to determine. 1 Tax Treatment of Code Section 132 Fringe Benefits.

Amazon Com Hydromate Electrolytes Powder Packets Drink Mix Low Sugar Hydration Accelerator Fast Hangover Party Recovery With Vitamin C Peach Iced Tea 30 Sticks Health Household

Section 140C Income Tax Act 1967 Interest expense subject to section 140C Interest expense under section 140C is as defined in subsection 140C3 where interest expense means.

. Get A Free IRS Tax Relief Consultation. Ad Trusted A BBB Member. A relief from Malaysian tax is given unilaterally pursuant to section 133 of.

These limits are indexed for inflation. Agreement with Malaysia and Claim for Section 133 Tax Relief HK-10 InstalmentsSchedular Tax Deductions Paid 31 HK-11 Not Applicable to Form BE Not Enclosed -. Solve All Your IRS Tax Problems.

Ad BBB A Rating. Each years Section 132 Plan benefit amount is found in the corresponding years IRS Publication 15-B Employers Tax Guide to Fringe Benefits. Tolakan cukai seksyen 110 lain-lain Section 110 tax deduction others Pelepasan cukai seksyen 132 dan 133.

Get Professional Help Today. Section 132 - Refers to tax relief in respect of income derived from Malaysia which has been subjected to tax in Malaysia as well as countries outside Malaysia. Able to income tax.

Was pending against the person concerned when the search was authorised under the said sub- section Earlier section 132 was substituted by the Finance Act. Property tax relief - NJ Division of Taxation. Section 132 in The Income- Tax Act 1995.

Find Out Now For Free. About the Company Section 132 And 133 Tax Relief. Get Professional Help Today.

How IRS Section 132 Works. - As Heard on CNN. - As Heard on CNN.

6652 of this title and section 409 of Title 42 The Public Health and. End Your IRS Tax Problems Today. Http Www Hasil Gov My Pdf Pdfam Samplerf Guidebook C2019 2 Pdf.

107-16 shall not apply to the provisions of. Trusted Tax Resolution Professionals to Handle Your Case. Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side.

Defend End Tax Problems. Ad Dont Face the IRS Alone. Cuellar Henry D-TX-28 Introduced 01032019 Committees.

Title IX of the Economic Growth and Tax Relief Reconciliation Act of 2001 Pub. This rule is set out in Section 262. Tax relief under section 133 of the ITA PwC TaXavvy Issue 2-2019 4 Tax deduction for expenses incurred in periods after the rental income was received in.

Program the employee pays for fare media with after -tax amounts. CuraDebt is a company that provides debt relief from Hollywood Florida. Tax relief under section 132 of the ITA.

The amendments made by this section enacting this section and section 4977 of this title amending sections 61 125 3121 3231 3306 3401 3501 and 6652 of this title and section 409 of Title 42 The. Lower municipal tax rate for four years in a row. Section 132 and 133 tax relief.

Ad Compare the Top Tax Relief Services of 2022. Singapore Indonesia Japan China Australia South Africa. Solve All Your IRS Tax Problems.

For 2017 the maximum monthly pre-tax contribution for mass transit is 25500 and 25500 for parking. Bilateral relief is given under Section 132 of the ITA when the foreign country has a double tax agreement with Malaysia eg. For 2017 the maximum monthly pre-tax contribution.

The employee then substantiates to C the amount of fare media expenses incurred during the month following reasonable substantiation. It was established in 2000 and has been a part of the American Fair Credit. What are those that can be filled in under.

Ad No Money To Pay IRS Back Tax. Section 132 And 133 Tax Relief Dapatkan link. Effective from the year of assessment YA 2004 foreign income1 remitted to Malaysia from outside Malaysia by resident individuals including trusts executors and unit trusts is.

It was founded in 2000 and has since become a part of the American Fair Credit. 2054 2088 2017 the Act amended section 132g by adding paragraph 132g2. A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is.

HK-6 Tax Deduction under Section 110 Others HK-8 Claim for Section 132 Tax Relief - Income from Countries With Double Taxation Agreement HK-9 Claim for Section 133 Tax Relief - Income from. Section 262 says except as otherwise expressly provided in this chapter no deduction shall be allowed for personal living or family expenses. Ad BBB A Rating.

Ad Compare the Top Tax Relief Services of 2022. Joint And Separate Assessment. This plan is a straightforward way for.

Click Now Find the Best Company for You. Section 132g2 provides that. A Practice Note addressing fringe benefits that are excludable from an employees gross income under Section 132 of the Internal Revenue Code.

Commuter or Transit Benefits Section 132 Parking mass transit expenses may be paid for with pre-tax dollars through a commuter plan. About the Company Section 132 Tax Relief. The IRS Section 132 transportation.

Tax Collector Township of. Section 11048a of the Tax Cuts and Jobs Act Pub. HR133 - Consolidated Appropriations Act 2021 116th Congress 2019-2020 Law Hide Overview.

CuraDebt is a company that provides debt relief from Hollywood Florida. 132 Effect of reliefs under sections 133 to 150 Related Commentary 1321 Subsection 2 applies where tax is charged in respect of a single-dwelling interest for a chargeable period that includes one or. A Interest on all.

Dont Let the IRS Intimidate You. ConsumerVoice Provides Best Most Updated Reviews to Help You Make an Informed Decision. 131 132 133 Schedule s 6 and 7.

Get Free Competing Quotes From Tax Relief Experts. ConsumerVoice Provides Best Most Updated Reviews to Help You Make an Informed Decision. Piscataway Mourns the Loss of Favorite Son Kenny Armwood.

Amazon Com Epielle Nourishing Hand Masks Hemp Rosemary Extract For Deep Moisturizing 100 Vegan Cruelty Free Gloves 6pk For Dry Hand Spa Masks Skincare Party Favors Beauty Personal Care

Amazon Com Tylenol Extra Strength Rapid Release Gelcaps 24 Ct Pack Of 2 Health Household

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

As An Accounting Student This Is All Too Familiar Accounting Jokes Accounting Humor Accounting Student

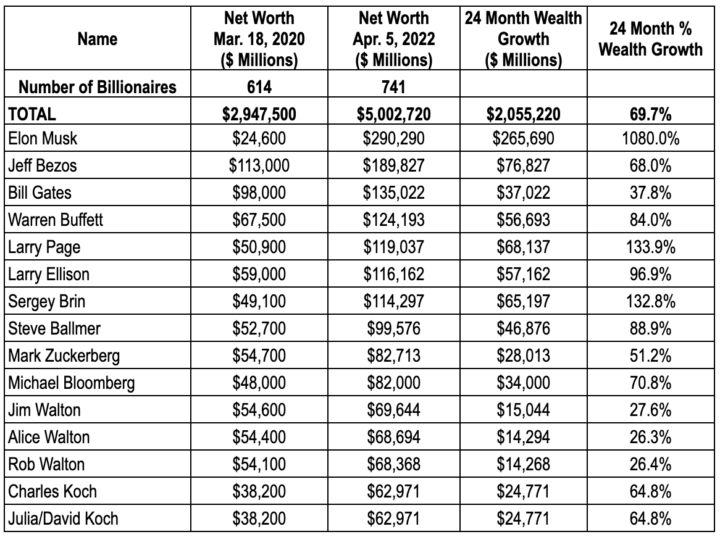

This Tax Day America S Working Families Are Paying Their Fair Share But America S Billionaires Are Not Americans For Tax Fairness

Ripples Effects Of Addiction Gut Wrenching Stories Ripped From The Hearts Of Those Affected By The Real Epidemic In Todays World Missions Messengers On Greene Patricia Mancuso Lisa Schlimm John Cherry Amy Recovery Messengers

Trends International Dark Knight Rises One Sheet Collector S Edition Wall Poster 24 X 36 Everything Else Amazon Com

/ScreenShot2021-07-31at3.56.40PM-f53c6447715749d79f242c0a0759fbb5.png)

Does Unearned Revenue Affect Working Capital

Cartoon Funny Eagle Giving Thumb Up Funny Cartoons Funny Cartoon

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Hidden Lost And Found Michaels Fern 9781496731456 Amazon Com Books

Evolution Of Smooth Eos Best Of Eos Lip Balm 9 Sticks 0 14 Ounce Pack Of 9 Beauty Personal Care Amazon Com

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

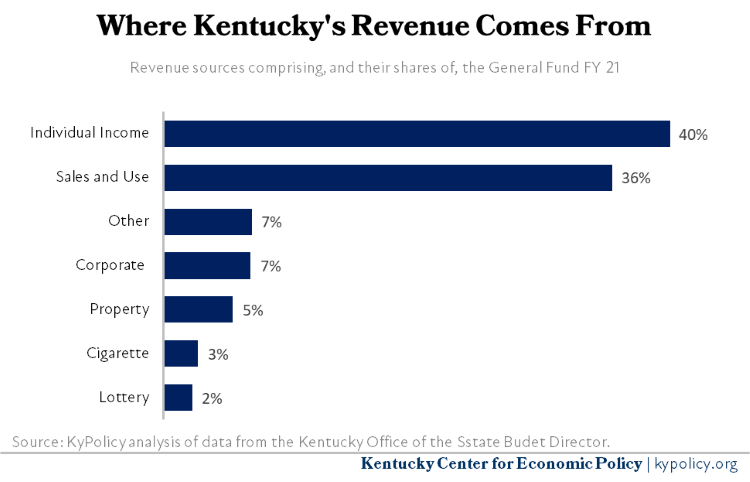

A Time To Invest Preview Of The 2022 2024 Budget Of The Commonwealth Kentucky Center For Economic Policy